How it works

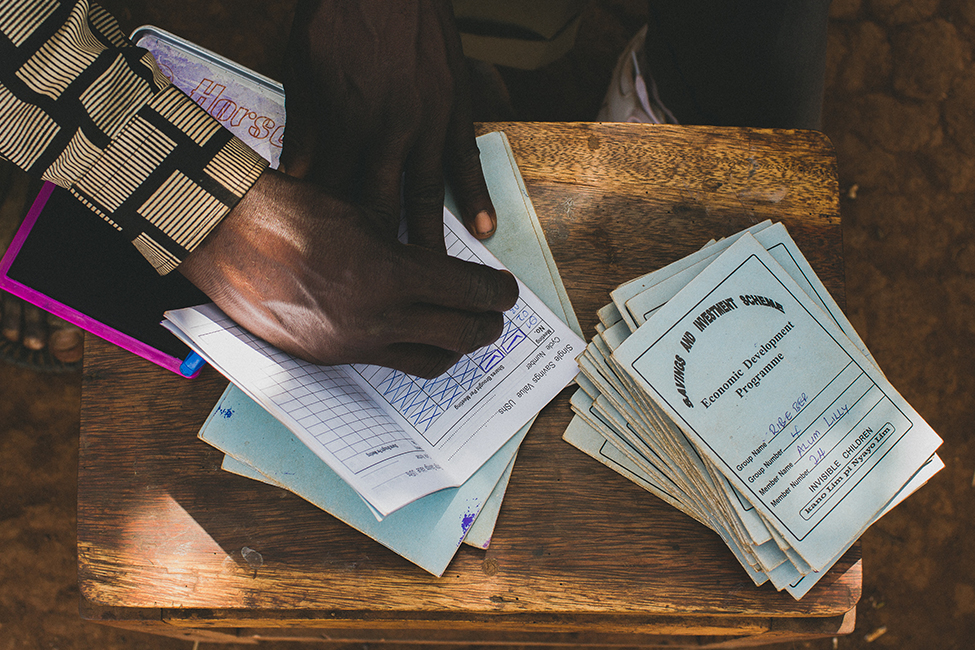

The Village Savings and Loan Associations (VSLA) program began in 2008, and is comprised of groups of rural community members who meet once a week with the goal of saving and loaning money together. Each member of the group saves, gives and takes out loans, repays their loans with interest, and individually invests this money into small businesses using standard VSLA methodology. Every group is internally managed by its own members, meets weekly and participates in savings cycles that last 8-10 months at a time.

In order to ensure group members are well versed in how to invest their loans, Invisible Children works with each group to provide Income Generating Activity (IGA) training. Each VSLA group is tasked with developing their group business plan in addition to their individual investments. After submitting their plan and receiving approval from Invisible Children Uganda staff, the group receives start-up capital to fund their activity. Groups invest in activities like goat and pig rearing and farming. Through the IGA training, they are given the tools needed to ensure that they receive a return on their investment.

VSLA is not a resource-heavy program—groups need only training, basic materials, and a metal lockbox to operate—and it revolves around skill acquisition and group-generated capital. Once a group has learned VSLA methodology, Invisible Children is able to start giving the group more autonomy, making viral growth possible. For something that takes just one hour a week to manage, VSLA provides members with three benefits: a way to save money, a way to earn interest, and a way to access previously unavailable capital.

Think people should hear about this?